Stock Exchange and Market Analysis

Technical Analysis (21)

OBV (On Balance Volume) is derived by Granvile (Joseph E. Granville) in his book written by 1963 to get a new secret stock market profits," the elaboration out of a sentiment indicator , used to be popular representatives of stock market trading volume in accordance with the number of price change direction , and plotted trend provides investors a measure of growth and decline of long and short at the time . when a Bobby wave of OBV is amplified, it expresses Popularity convergence and is characterized by the bull market . Conversely, when the energy influx OBV shrinking , it shows collapsing popularity and is the sign of the short market . Since the amount of leading indicators are divalent , to observe changes in volume generally allows early to judge whether the stock has a turning point . In order to grasp the OBV indicator , the characteristics it presents are as follows :

OBV (On Balance Volume) is derived by Granvile (Joseph E. Granville) in his book written by 1963 to get a new secret stock market profits," the elaboration out of a sentiment indicator , used to be popular representatives of stock market trading volume in accordance with the number of price change direction , and plotted trend provides investors a measure of growth and decline of long and short at the time . when a Bobby wave of OBV is amplified, it expresses Popularity convergence and is characterized by the bull market . Conversely, when the energy influx OBV shrinking , it shows collapsing popularity and is the sign of the short market . Since the amount of leading indicators are divalent , to observe changes in volume generally allows early to judge whether the stock has a turning point . In order to grasp the OBV indicator , the characteristics it presents are as follows :

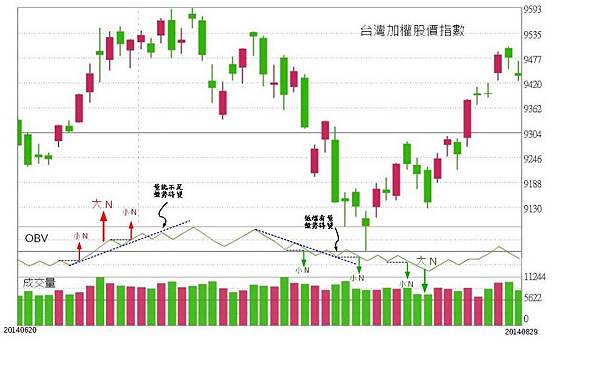

Figure.1 Energy Tide OBV (On Balance Volume)

1. The larger the differences of the stock investors , the reaction to the greater volume . Vice versa reduced . Thus daily and used to determine the sentiment long and short strength .2. Gravity Principle : volume equivalent energy market , the stock to rise like the object to be boosted up requires energy , and therefore the need to enlarge the volume Going process , by a rising section is essential . However, as Newton fell prediction Apple's free fall is as easy as it is , and there is no need to match the volume . Therefore, the price increase is rising , and the price drop is an inevitable result .

3. Inertia : The so-called dynamic is constant, the static is constant , the stocks with large stock price fluctuations will be accompanied by large fluctuations in volume , and the unpopular cold stocks usually have a relatively small fluctuation in their price .

The calculation method of the OBV trend line is simple and intuitive . As long as the stock volume of the stock is accumulated day by day , the cumulative method depends on the stock price rise and fall on the day . When the stock price is closed , the definition adds or subtracts to zero . Today's OBV value is equal to yesterday's OBV value. When the closing price is positive , the OBV value of yesterday is added to the daily trading volume ; when the closing price is negative , the daily trading volume is reduced by the OBV value of yesterday . The OBV trend chart often exhibits N- shaped fluctuations ( Figure 1 ). , when OBV former value increased over the time N when the font vertices , then a left arrow mark up , and vice versa at a stage before falling below each time N when the low-shaped , is written, a down arrow mark .When the N -line pattern appears continuously in the rising process , you should start to pay attention to the reversal signal . When there is a large N- shaped pattern , it indicates that the rising market is nearing completion , and the stock price may be reversed at any time . The same method can also be applied in the falling stage.

4. If the stock price K- line chart and OBV trend deviate from each other , it means that the long- selling force is about to be exchanged , and the stock market is about to change . The stock operation should be extra careful .

5. If the OBV trend line is in the horizontal direction for a period of time , it means that the market chips are still in the stage of brewing . Once it starts to rise , it is possible to start the next big market at any time . If the change in the volume of transactions is also simultaneously amplified , the long market can be established .

Next, let us according to OBV import mathematical formulas Excel spreadsheet :

OBV t : a first t-1 day OBV value plus the first t index value date V t

OBV t = OBV t -1 + V t

V t : volume indicator value on the tth day

When C t = C t - 1 , then V t =0

When C t > C t - 1 , then V t = the volume of the tth day , which is positive .

When C t < C t - 1 , then V t = - ( the volume of the t- day ) is negative .

C t : the closing price of the day of t

The principles of application of OBV indicators can generally be classified into the following points for reference :

1. When the OBV indicator deviates from the stock price trend , it is a signal of market reversal :

- The stock price rose but the OBV indicator fell , indicating that the market's price-tracking power is weak , and the rising momentum is insufficient . The stock price may reverse downward at any time .

- The stock price fell but the OBV indicator rose , indicating that the market's dips will strengthen and the popularity will return . The market may stop falling and rise , which can be regarded as an opportunity to buy signals .

i. Share price and OBV indicators are slowly rising , indicate a steady upward market , bull market unchanged , shareholders may continue to hold , empty-handed may still opportunistic approach .

ii. The shares fell OBV indicator also slow down , indicate the market gradually grind , short trend change , shareholders should sell stand-leave , empty-handed those who patiently wait and see appropriate places .

3. When the stock market is in a horizontal arrangement , the trend of the OBV indicator will become an important reference indicator for long-term changes :

i. If the OBV indicator starts to rise upwards , it means that some people in the market are taking over the floating amount of chips , and the bottom has begun to emerge . The empty hand can wait for an opportunity to enter the market .

ii. If the OBV indicator starts to weaken downwards , it means that some people in the market are gradually taking off their shares , lowering their chips and looming their heads . Shareholders should wait for an opportunity to play in order to avoid jail .

4. N- type of OBV indicator ( Figure 1 ) short-term operation :

i. When the OBV indicator is in a rising N- shaped trend , the N- shaped high point of each band usually represents a large resistance area where the market continues to break upwards , and the short-term back-up rate is large . If you can cross the N- shaped high point in one fell swoop , it represents the market. Breaking through the pressure zone , the bull market will continue .

ii. When OBV when a rapid rise in the trend indicators , represents most of the buying has been admitted , to support the stock price strength weakened , the market may pullback at any time , once the OBV indicator began to reverse downward , expressed Going fatigue , obvious to sell Signal number .

iii. When the OBV indicator from the N reverse the downward font highs , the time and the decline accelerated , indicates that the disc has the potential to turn mostly empty . Start N -shaped downtrend . In each band N process fonts usually represent low prices decline In the large support area , the short-term rebound probability is large . But when the downtrend breaks through the previous wave of N- shaped lows , it usually means that the market has lost short-term support , and the market is still dominated by the empty side .

Although the above is the general rule of entering and exiting stocks , but because the calculation principle of OBV index is too simple , it is more suitable for short-term operation analysis , and the stock property is different . It is better to observe the stock price trend chart of the subject matter for at least one year. The technical indicators are appropriately corrected . In order to facilitate the readers to use the OBV indicators , the author still uses the model of Juyang (template) to continue to produce analytical samples in Excel format for readers' reference :

template21.xlsx

In addition to this sample " historical stock price " provides spreadsheet OBV the external reference index , the second spreadsheet provides the candlestick graph , volume and OBV trend chart for the reader . If any mistakes found, please don't hesitate to correct me . Thank you !In addition , the author made EXCEL spreadsheet for various indicators (moving average , RSI, BIAS, stochastic KD line, William indicator , MACD, CDP and Bollinger band) for stock analysis , and further produced candlestick charts and other technical indicators on the same chart , interested readers can refer to Ref.1.

Reference (Ref):

1. Investment Financial Notes - Stock Technical Analysis

How much is a slot machine at Harrah's Casino Resort?

ReplyDeleteSlots at Harrah's Casino 구리 출장샵 Resort. 양산 출장안마 777 Harrah's Blvd. Atlantic City, NJ 08401 - Use this simple 광주광역 출장마사지 form to find hotels, 전라북도 출장안마 motels, and 경산 출장안마 other lodging near the casino.